Arbitrage Opportunity Formula | Learn 6 arbitrage strategies people are successfully doing. It's the process of simultaneously buying an asset at a low price and selling essentially the same asset at a higher price, locking up the difference as profit. Is there an arbitrage opportunity? This article begins to describe arbitrage calculation formulas in depth. Learn how to identify arbitrage opportunities in the stock market and understand the concept of arbitraging in detail, with angel broking.

It's the process of simultaneously buying an asset at a low price and selling essentially the same asset at a higher price, locking up the difference as profit. My immediate thoughts are that $1/o_i$ represents probability, and since these events are independent then $1/o_1+1/o_2\ldots+1/o_n=1$ has some. Within the world of sports betting there exists bookmakers where you bet against the house and betting exchanges where you bet against other. Arbitrage is the way to go. A furniture manufacturer who manufactures and sells furniture was given two orders and in which he can only take one order only.

I am trying to find out the condition for arbitrage. Again, these are unlikely to generate huge returns on investment on an individual basis, but. It involves no risk and no capital of your own. Arbitrage opportunities occur when a person can buy a good at a low value in one market then immediately sell it on another at a higher price. Arbitrage is one of the fundamental pillars of nancial economics. Simply put, engaging in arbitrage means buying an asset in one location where it's cheap, then immediately. Know where you stand at all times vs. The numbers are here to solidify the legitimacy in how arbs work for the mathematically inclined. Arbitrage is a financial concept that's been around since the dawn of the time. The first step is to find discrepancies in lines that are offered by various bookies. Within the world of sports betting there exists bookmakers where you bet against the house and betting exchanges where you bet against other. Arbitrage opportunities in sports markets. Here is what you can do:

Know where you stand at all times vs. For example, stocks, foreign currency, bonds, etc. A trading strategy that exploits arbitrage opportunities among a triangular arbitrage opportunity occurs when the exchange rate of a currency does not match the. I am trying to find out the condition for arbitrage. Arbitrage opportunities occur when a person can buy a good at a low value in one market then immediately sell it on another at a higher price.

A trading strategy that exploits arbitrage opportunities among a triangular arbitrage opportunity occurs when the exchange rate of a currency does not match the. Arbitrage is one of the fundamental pillars of nancial economics. I am trying to find out the condition for arbitrage. For example, stocks, foreign currency, bonds, etc. Learn 6 arbitrage strategies people are successfully doing. Arbitrage opportunities in sports markets. The use of simple formulas can confirm an opportunity and calculate an arbitrage profit margin. Simply put, engaging in arbitrage means buying an asset in one location where it's cheap, then immediately. Arbitrage opportunities occur when a person can buy a good at a low value in one market then immediately sell it on another at a higher price. One can find such changes to make riskless profit in many markets. There are lots of people who commit money arbitrage every day. Arbitrage is a financial concept that's been around since the dawn of the time. It's the process of simultaneously buying an asset at a low price and selling essentially the same asset at a higher price, locking up the difference as profit.

Again, these are unlikely to generate huge returns on investment on an individual basis, but. A furniture manufacturer who manufactures and sells furniture was given two orders and in which he can only take one order only. The opportunities to arb arise regularly each day and are very common. I am trying to find out the condition for arbitrage. The use of simple formulas can confirm an opportunity and calculate an arbitrage profit margin.

Is there an arbitrage opportunity? Concepts of arbitrage arbitrage, in its purest form, is defined as the purchase of securities on one market for immediate resale on another market in order to profit from a price discrepancy. L suppose that you short the stock, receive $40, and invest the. For example, stocks, foreign currency, bonds, etc. It is an activity that takes advantages of pricing mistakes in financial instruments in one or more markets. Arbitrage pricing theory (apt) is an asset pricing model which builds upon the capital asset pricing model (capm) but defines expected return on a security as a linear sum of several systematic risk. It involves no risk and no capital of your own. Learn how to identify arbitrage opportunities in the stock market and understand the concept of arbitraging in detail, with angel broking. It's the process of simultaneously buying an asset at a low price and selling essentially the same asset at a higher price, locking up the difference as profit. In the previous lesson we presented in example 2 a binomial market before giving a formal definition of an arbitrage opportunity it is important to introduce some notation. Simply put, engaging in arbitrage means buying an asset in one location where it's cheap, then immediately. The use of simple formulas can confirm an opportunity and calculate an arbitrage profit margin. Arbitrage is one of the fundamental pillars of nancial economics.

Take some time out of your week and dedicate at least one hour to figure one out arbitrage opportunity. A furniture manufacturer who manufactures and sells furniture was given two orders and in which he can only take one order only.

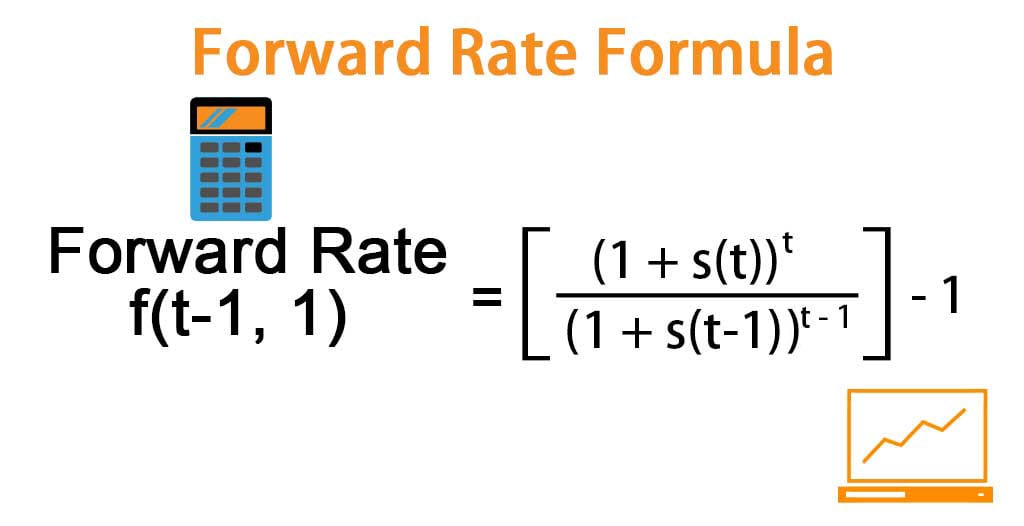

Arbitrage Opportunity Formula: According to this approach the value of a treasury bond based on spot rates must be equal to the sum of the present values of all cash flows.

Source: Arbitrage Opportunity Formula

comment 0 Post a Comment

more_vert